Yesterday, Li Lu turned 58 years old. In investing circles, this is considered a rookie in the field ;)

To celebrate his Birthday, I put together 8 Investing Lessons I learned from him through interviews, lectures, and reading material.

I also linked his longest available lecture and his book recommendations at the end.

1. Investment Philosophy

Li Lu is a value investor, which is not surprising considering he’s been called the Chinese Warren Buffett. One of his best friends, Charlie Munger, once said that all intelligent investing is value investing. Why is that?

First of all, the market isn’t built for value investing.

It is built to increase the urge to speculate, which is why businesses are so often misplaced in the short term. Value investors benefit from this circumstance by taking a long-term mindset.

Second, the stock market buys and sells securities, value investors buy and sell companies. This is more than a semantic difference. Stocks are much more volatile than the underlying businesses. If you trade the stocks, you try to benefit from these short-term movements, which is a 50/50 game most of the time.

If you trade the businesses, the odds heavily favour you. You can buy businesses with a great long-term outlook in short-term trouble, which happens more often than one would think.

GigaCloud Technology might be such a case. Upgrade to Paid to not miss out on the Deep Dive. (Smooth Marketing, Right ;) )

2. Be Yourself, not Warren Buffett

Li Lu is called the Chinese Warren Buffett, but he didn’t give this name to himself. And I’m sure he wouldn’t say that about himself. Not only because of the difference in their track records but also because he wants to be the best investor he can be. Not clone someone else.

People have different skill sets and interests. Do not try to be someone else and invest in things you don’t know or don’t interest you.

Stay in industries where you have an edge or interest. It’ll limit your investment opportunities, obviously, but that’s fine. Actually, it’s good because you won’t follow the herd into every hot topic just because you fear missing out.

That’s the great thing about investing. To use Buffett’s famous baseball analogy:

“The trick in investing is just to sit there and watch pitch after pitch go by and wait for the one right in your sweet spot. And if people are yelling, ‘Swing, you bum!’ ignore them.”

3. Be a Journalist

There are many similarities between journalism and investing, especially in the research process. Most investors act like yellow press journalists. Their research is shallow, and they chase headlines instead of well-researched stories.

Great investors are like research journalists. They view a company as a possible story and need to find out everything there is about it. Only when all questions are answered, they form their opinion.

What the final article is to the journalist, the investment thesis is to the investor.

4. Commitment Bias

One of the toughest hurdles in that research process is the presence of biases and heuristics to shortcut the process.

One of these biases is the commitment bias. To avoid this one, Li Lu rarely agrees to public appearances. The more you talk about investments, the more you talk yourself into them. The perceived knowledge about a company increases without adding any actual insight.

Avoiding biases is also a big part of my investing process and my investing checklist. Learn why it’s essential and how it shapes my investing checklist, available now on the lobby of my website.

Every Paid member has free access to it as soon as he subscribes (the PDF will be in the Welcome Email).

5. ROIC

Just like Charlie Munger, Li Lu emphasises the importance of ROIC as a metric for superior performance and competitive advantages.

As value investors, the price you pay for a company is a crucial factor. However, the longer your holding period becomes, the less important your entry price will be, and the more important factors like the ROIC will become.

In the long run, your return will get closer and closer to the company's ROIC. The importance of your entry price slowly fades away. But remember that this only applies to positions you have held for many, many years.

6. Underlying Changes vs. Volatility

As explained before, stock prices are a lot more volatile than the underlying businesses. Value investors, therefore, pay attention to the slow, long-lasting changes in the business model or competitive landscape instead of stock prices.

7. Self Defence

To Li Lu, the Margin of Safety is a concept of self-defence. Even if the company is more valuable than the market gives it credit for, there are plenty of ways to destroy this advantage quickly.

A common example is burning through cash reserves. Companies can start out looking like an opportunity if they have a comfortable cash position that makes the balance sheet look healthy.

The problem is that bad management decisions or bad operational outcomes can quickly burn those cash reserves. That’s why it can make sense to discount cash positions if you see signs of unprofitable investment spending.

In the end, all of this should be considered and you should always use a margin of safety to account for such scenarios.

8. Uninvestable

Some industries or companies are impossible to value. Li Lu often gives the example of restaurants.

Even if the business is great at the moment, there are little to no durable advantages, which could cause a quick downswing for any business in the sector. Another example are fashion brands that experience short-term hype.

Investors shouldn’t try the impossible and focus on what can be valued by projecting future cash flows and earnings.

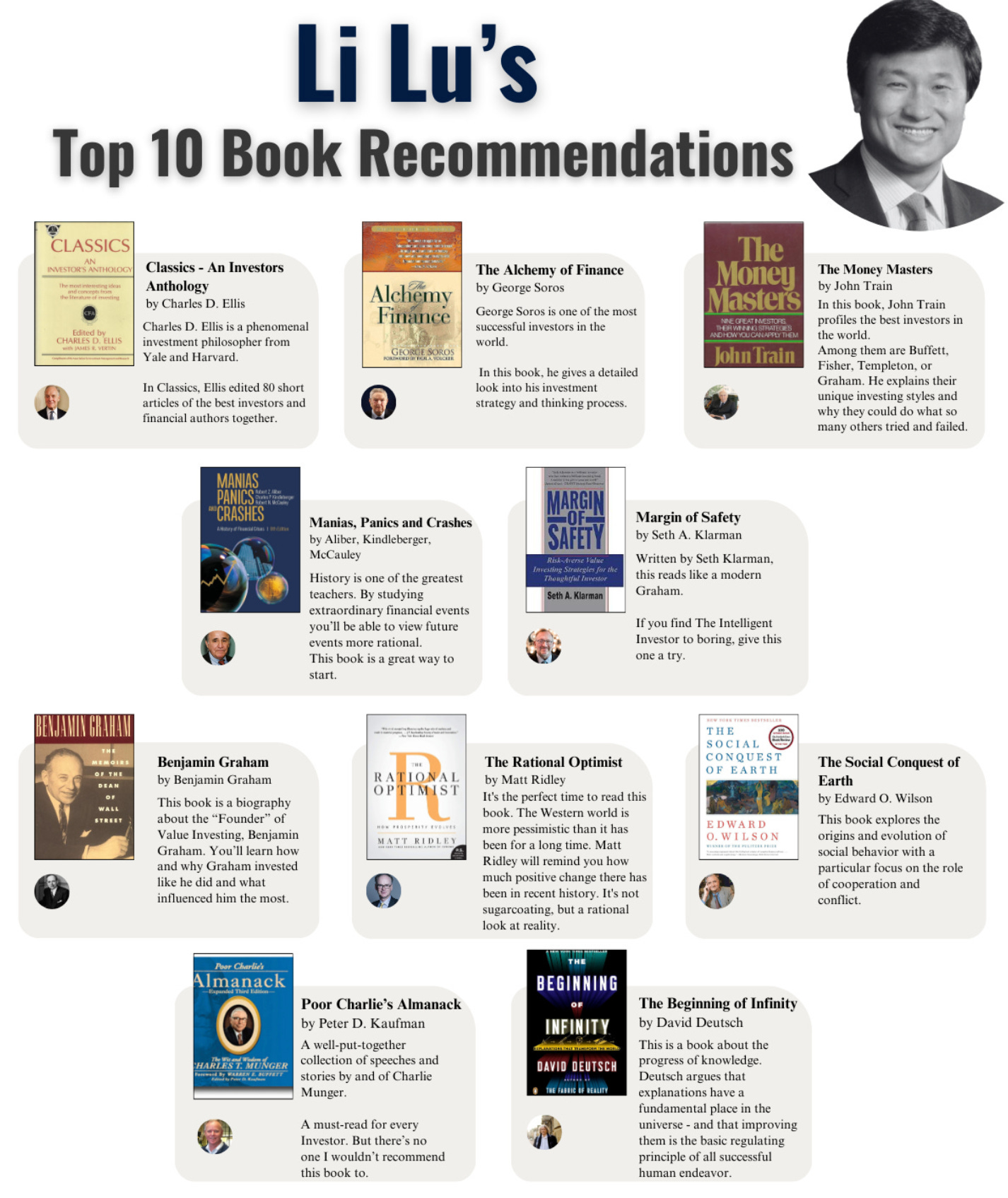

Li Lu’s Book Recommendations:

More book recommendations here:

Bookshelf - Inspiration Reading Material

Li Lu’s Columbia Lecture:

That’s it for today!

As always, thanks for tuning in, and have a great Sunday!